pa inheritance tax exemption amount

However you are still liable for the amount due. If an estimated tax payment is made within three months of death a five percent 5 discount on the tax due will apply.

What Is A Homestead Exemption And How Does It Work Lendingtree

New Inheritance Tax Exemption for Military Deaths.

. A dealers Pennsylvania Sales Tax exemption certificate is a valid form of notification to you from a dealer. This article explains in depth how the inheritance tax may affect you. The another change under the 2000 tax act has to do with an exemption from tax that applies to assets that pass from a child to a parent.

Wwwrevenuepagov CONTACT INFORMATION For additional inheritance tax or safe deposit box. The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to. I cant speak highly enough of everyone at the firm.

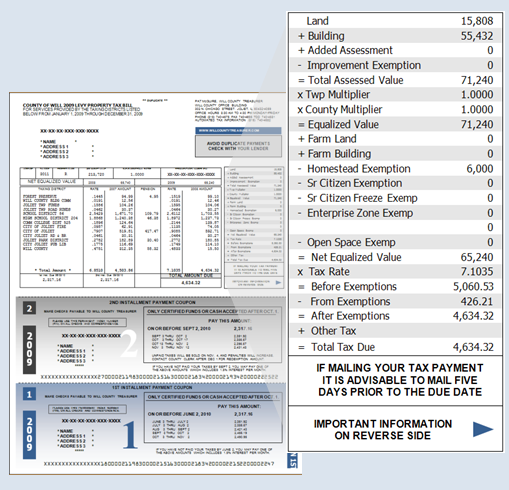

Today Governor Tom Wolf announced that thousands of the older and disabled Pennsylvanians who have already received a rebate on property taxes or ren. As it shows the exemptions range from 1 million in Massachusetts and Oregon to 585 million in New York. There is no tax on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

This exemption is portable. States that the applicable federal rate is the federal short-term for the period for which the amount of foregone interest is being determined compounded semi-annually Because federal rates can change can change monthly the calculation of interest would. Connecticuts 51 million exemption for 2020 puts it 9th among the 13 jurisdictions.

The fair rent of the property is 15000 per month. Sushil will get in the PY. If a taxpayer fails to pay their Real Estate Tax on time charges called additions will be added to the principal amount of the tax.

The inheritance tax is based on the relationship to the deceased. Upon the death of a child age 21 or younger there is no longer any tax on assets that pass to that childs parent or stepparent. The tax rate varies depending on the relationship of the heir to the decedent.

Your partners income is 20000 and their Personal Allowance is 12570 so they pay tax on. Loan amount 1000000 Rate 10 pa. New Inheritance Tax Exemption for Military Deaths.

Jenkintown PA 19046 Telephone. GAV NIL Municipal taxes NIL NAV NIL Deduction 24 a NIL. Many factors will influence the amount of inheritance tax your.

Client Review I worked for Peter Klenk for 4 wonderful years. A withdrawal removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property. A direct heir a child or grandchild will see their inheritance taxed at a rate of 45 percent.

All non-relatives or family members of indirect lineage have an inheritance tax of 15 percent. Additions accrue at the rate of 15 per month beginning April 1 and continue increasing by 15 each month until January 1 of the following year. Pennsylvania does not levy an excise tax on gasoline or diesel purchases.

Pennsylvania Small Games of Chance Tax. For each transaction provide a receipt with the amount of sweetened beverages supplied in the transaction and the amount of tax imposed on that transaction. 5 Greentree Centre 525 Route 73 North.

Your income is 11500 and your Personal Allowance is 12570 so you do not pay tax. This means that with the right legal maneuvering a married couple can protect up to 2236 million after both spouses have died. Late returns are subject to penalties and interest.

Table 3 shows for each of these jurisdictions the estate tax exemption amounts ie taxable estate thresholds and top statutory rates for 2020. In order to determine the amount due under the PA Inheritance Tax a Personal Representative must ascertain the value of the decedents assets as of the date of death. Siblings of the departed will pay 12 percent in inheritance taxes.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. Real Estate Tax is due by March 31 of each tax year. This can appear in an invoice or a supplemental form provided by the City.

There is still a federal estate tax. The income chargeable to tax in respect of amount received on reverse mortgage for his self-occupied. For eligibility refer to Form 12277 Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal Revenue Code Section 6323.

If an estate exceeds that amount the top tax rate is 40. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022. The tax is 45 for direct descendants children grandchildren etc 12 for siblings and 15 for other heirs.

However interest on demand loans with a fixed principal amount outstanding for an entire year can be determined using the. The amount of exemption that Mr. Pennsylvania Inheritance Tax Safe Deposit Boxes Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will or intestacy.

One-time Bonus Rebates on Property TaxesRent to Be Distributed Starting t. New Jersey imposes inheritance taxes on decedent estates at the time of death.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Exemption 2021 Amount Goes Up Union Bank

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Die In Nebraska How The County Inheritance Tax Works

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

10 Ways To Be Tax Exempt Howstuffworks

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia